TL;DR

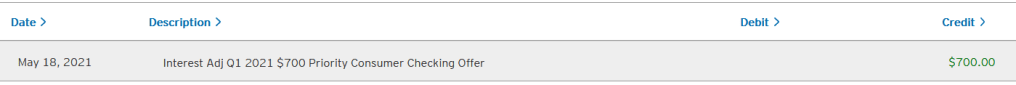

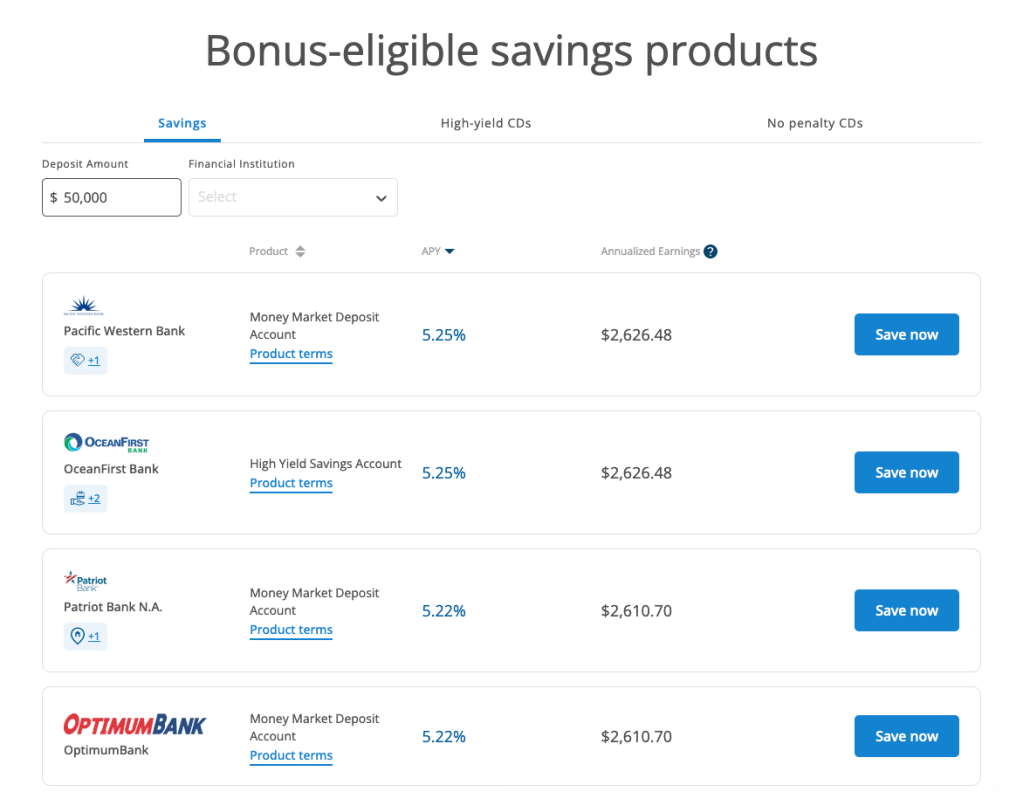

- Rates have gone up and cash can now earn decent yield (5.25% as of Aug 2023)

- FDIC insurance is critical given SVB and other bank failures

- Raisin offers a easy to use platform to maximize cash yield on FDIC insured accounts

- All earnings are taxable on your 1099-INT

- Took me about 2 minutes to open up the account and receive $25 bonus with a $5,000 deposit ($750/hour)

- referral: Get started at Raisin with code warrenp012362. Select the bank you want to deposit funds to and it will start the registration process

- monitor rates using: yieldalarm.com ($6.99/year)

Why keep so much cash?

$50,000 is a lot of money, but could be the right number for a emergency cushion if you have a household annual spend of $100,000+. This means 6 months of highly liquid funds for emergencies. Some guidance from investment professionals here.

Is it worth the effort?

$25 sign up bonus for 2 minutes of time and $5k earning higher yield is about $750/hour, so from an effort basis, the answer is a yes for me!

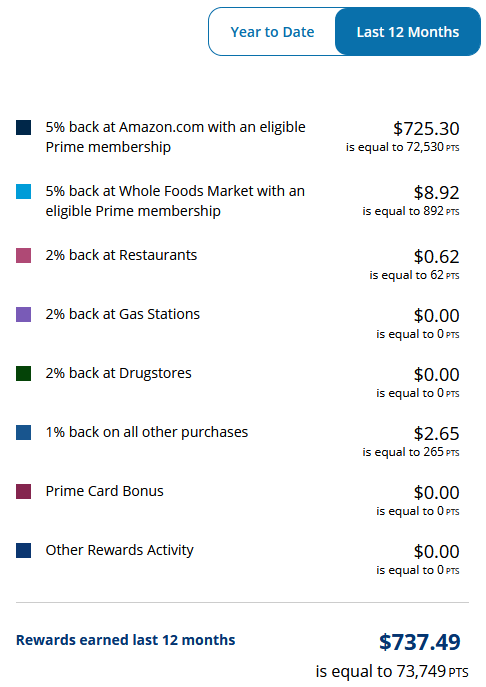

On a longer term basis, the best rate is 5.25% and previously, I was using Betterment which is at 4.75%. By being a bit more active in managing these savings, the difference can be meaningful. If you’re cash is with a major bank, the difference will be even more extreme.

| Principal | 4.75% | 5.25% | Difference |

| $5,000 | 238 | $263 | $25 |

| $25,000 | $1,188 | $1,313 | $125 |

| $50,000 | $2,375 | $2,625 | $250 |

| $100,000 | $4,750 | $5,250 | $500 |

| $250,000 | $11,875 | $13,125 | $1,250 |

Any more effort required?

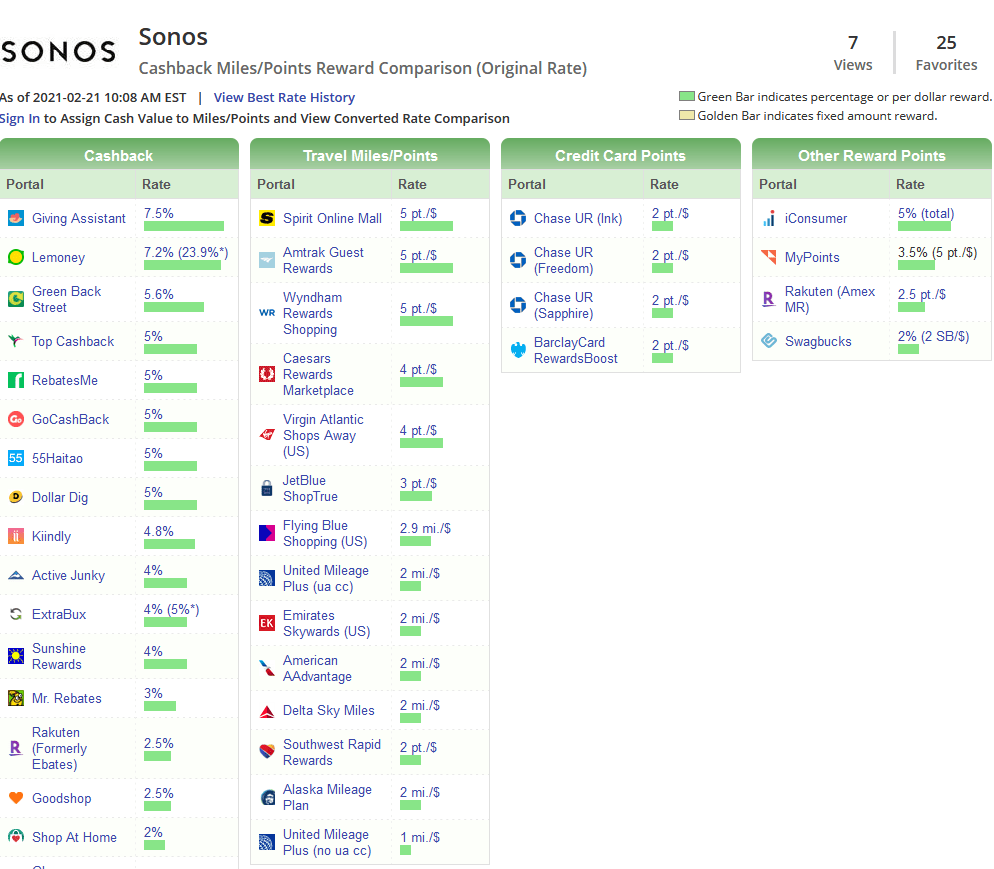

Raisin is still a pretty early stage company and not all features are there. There is no rebalancing or alerting function. Fortunately, someone’s build a basic site that monitors rates.

https://yieldalarm.com costs $6.99/year, but you can see a small difference will make a meaningful difference

What else to consider?

This is fairly light touch to manage, but as rates change, it will require regular rebalancing which will take a few minutes each time you do it. I understand you need to move money out of Raisin to your regular bank account and then transfer it to the new financial institution via Raisin.

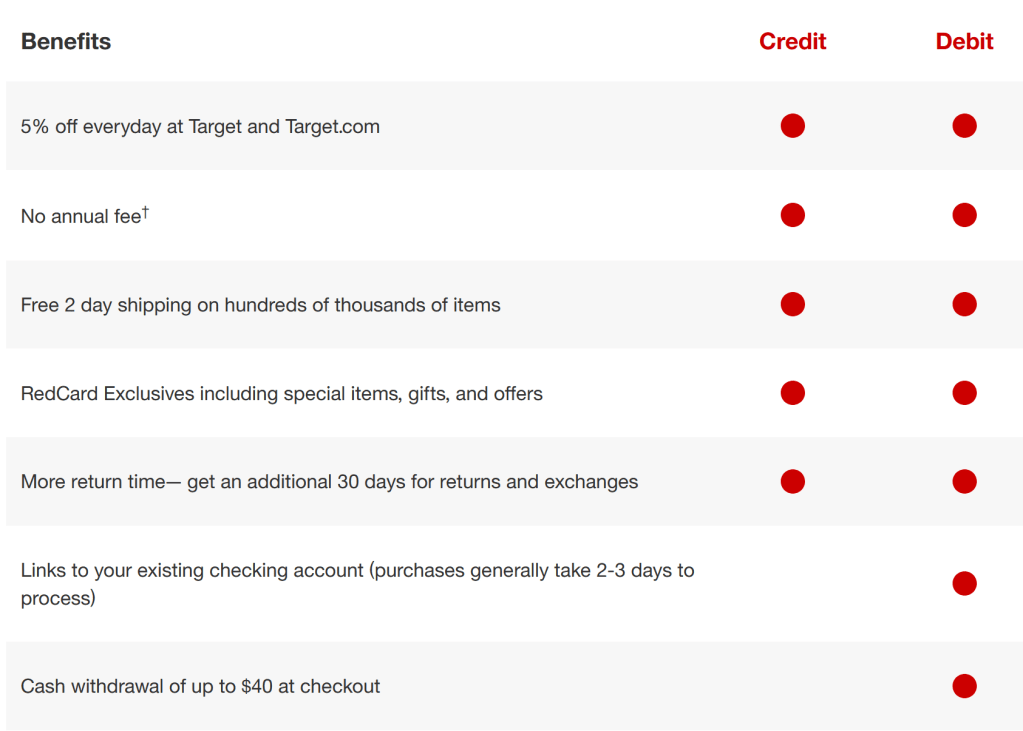

The financial institutions that are offering the higher rates are not the strongest, but FDIC insurance should effectively mitigate this.

I personally have enough confidence in the omnibus account structure, but it adds complexity.

Overall, I’m comfortable enough to move my cash reserves and those of my extended family, but you should do your own due diligence. I started with $5,000 on August 3, 2023 and will update after I’ve the bonus hits.